Almost overnight the Coronavirus pandemic upended daily life throughout the United States and across the world. In response people from all walks of life have embraced wholesale cultural changes, creating a new normalcy that is likely to persist long after the disease itself. From Wall Street to Main Street, the impact has reshaped industries and behaviors.

Ranching, a way of life celebrated for its traditions and independence, has adapted to the circumstances with equal solemnity. The impact has been at turns pronounced and nuanced. Perhaps not surprising, it has created a return to the heritage that has long defined the American West.

DISRUPTION IN THE MARKET

Like many sectors of the economy, the COVID-19 pandemic has taken a significant toll on the country’s ranchers. Outbreaks at meat processing facilities, like the JBS USA plant in Greeley, Colorado, drew attention to the fragility of the nation’s food supply chain. For ranchers, that often meant bottlenecks that prevented livestock from getting to consumer markets. Which, at its worst, forced hard decisions about herd euthanasia.

“The thought of euthanizing animals and those animals going to waste goes against every grain of our being,” one rancher told ABC News in May. Cattle ranchers stand to lose more than $13 billion because of disruptions, the article notes.

At the height of the pandemic as much as 40 percent of the nation’s meat processing capacity was shut down. That reality reignited a dormant debate over regulation and decentralizing the food supply chain. About 80 percent of U.S. processing plants are owned by four corporations, all of which experienced closures and labor shortages because of the pandemic.

As a result, smaller processing plants that often specialize in local, grass-fed beef, quickly backed up. Many are now booked four years in advance, which has pushed the bottleneck problem down to local ranchers.

“All these custom slaughter facilities, those are the organizations that we should be propping up and giving them the tools and opportunities to be able to supply directly to their little local communities,” says Tyler Lindholm, a Wyoming state representative and rancher.

CLOSE TO HOME

The pandemic has forced changes closer to home, too, not just down the supply chain. Like nearly every industry, ranchers are embracing preventative measures—social distancing, face masks and sanitation practices. Livestock auctions have gone virtual. County fairs, once community-wide celebrations, have pared down their programs to only those that can operate within new health guidelines.

“We are paying close attention to our industry associations regionally, nationally, and internationally to learn what they are doing,” Teton County Fair manager Rachel Grimes said ahead of our area’s 64th annual county fair. “All we can do right now is plan for the worst and hope for the best.”

Ultimately, the event was trimmed down to the 4-H livestock shows, open horse classes and exhibit hall. Which welcomed community arts and crafts projects. While the week-long event looked different than years past, turnout remained strong. The livestock sale saw a 25 percent increase in total volume.

“If these young people are going to put in the work, I’m going to support it,” said Zia Yasrobi, a buyer at the sale.

MOVING TO THE WEST

The westward movement phenomenon accelerated, if not brought about, by the COVID-19 pandemic. In growing numbers, discerning real estate buyers have begun seeking properties that provide, in a word, space. And it seems none combine the considerations of privacy, solitude and conversation more than ranch properties.

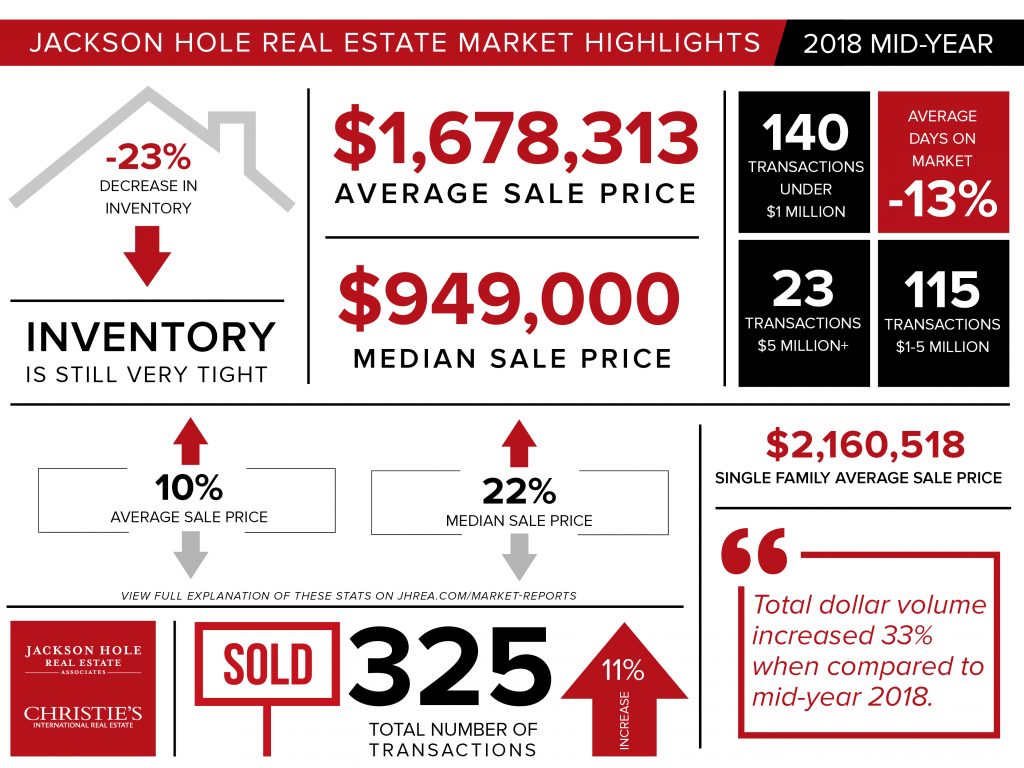

In the immediate wake of the COVID-19 pandemic, real estate markets cratered nationally by and large. But as panics subsided, markets quickly rebounded. The spring and summer have recorded many record transactions, both across the country and here in Wyoming.

“The situation has lit a fire under buyers,” says Chopper Grassell. “Even before the pandemic, there was a growing demand from people looking to escape the cities in favor of properties that offer greater space and privacy. COVID didn’t start that trend, but it has accelerated it. And it’s likely to continue, especially as remote working becomes the new normal and people are putting a higher value on quality of life.”

Here in Teton County, the luxury market (above $3 million) saw a 164 percent increase year-over-year through the mid-year point, while the average days-on-market fell seven percent. Vacant land prices increased more than 50 percent, helping to drive up the average sale price above $2.5 million. That was compelled largely by a flurry of activity through June, which continued to through the third quarter.

Across the country, the Coronavirus pandemic has reshaped daily life. It is no different on the country’s ranches. Yet, in this new era, the beckon of the West that has long captivated society’s hearts and minds is alive and well and as strong as ever.

To find your own Western paradise, contact Richard and Chopper.

*Article brought you by Western Ranches.